Understanding Prenuptial Agreements in Illinois: Key Clauses and Conditions

Prenuptial agreements, often referred to as “prenups,” are legal documents that couples enter into before marriage. These agreements outline how assets and financial matters will be handled during the marriage and in the event of a divorce or death. In Illinois, as in many states, the enforceability and contents of these agreements are subject to specific laws and regulations. For couples considering a prenuptial agreement in Illinois, understanding the common clauses and conditions, as well as the legal framework governing these documents, is crucial. In this comprehensive guide, we’ll explore the intricacies of prenuptial agreements in Illinois, providing insight into why they’re an essential consideration for marrying couples.

The Legal Foundation of Prenuptial Agreements in Illinois

Prenuptial agreements in Illinois are governed by the Illinois Uniform Premarital Agreement Act (IUPAA). Under the IUPAA, prenuptial agreements must be in writing and signed by both parties. These agreements become effective upon marriage and can cover a wide range of financial and property issues. However, it’s important to note that prenups cannot adversely affect child support rights or decide child custody issues in advance.

Common Clauses in Illinois Prenuptial Agreements

1. Asset and Property Division

One of the primary purposes of a prenuptial agreement is to outline how assets and property will be divided in the event of a divorce. This includes both assets acquired before and during the marriage. Couples can decide which assets will be considered separate property and which will be marital property, subject to division.

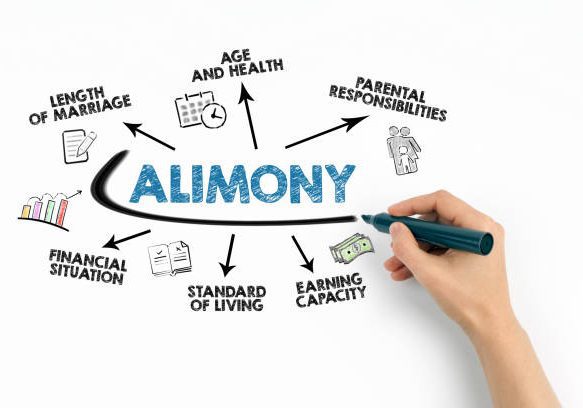

2. Spousal Support

Prenuptial agreements often address the issue of spousal support, or alimony, specifying whether one spouse will be entitled to support in the event of a divorce, the amount of support, and the duration. These terms must be fair and reasonable at the time of the divorce to be enforceable.

3. Debt Allocation

Couples can use a prenup to delineate how any debts incurred before or during the marriage will be handled. This can protect one spouse from being responsible for debts accumulated by the other spouse.

4. Estate Planning and Inheritance Rights

Prenuptial agreements can also specify how assets will be distributed upon the death of one spouse, which can be particularly important for those with children from previous relationships or significant estate assets.

5. Retirement Benefits

The agreement can outline how retirement benefits are to be treated, ensuring that both parties have clarity about their financial rights and obligations.

Conditions for Enforceability

For a prenuptial agreement to be enforceable in Illinois, certain conditions must be met:

- Voluntary Execution: Both parties must voluntarily sign the agreement without coercion or undue pressure.

- Full Disclosure: There must be a full and fair disclosure of all assets and liabilities by both parties at the time of signing the agreement. Alternatively, the party must voluntarily waive in writing the right to disclosure beyond what was provided.

- No Unconscionability: The agreement must not be unconscionable at the time of signing. An agreement might be considered unconscionable if one party is left without a reasonable means of support, waives rights to alimony that they would otherwise be entitled to, or if there are other significantly unfair terms.

- Independent Legal Representation: While not strictly required, it’s highly recommended that each party has their own attorney review the agreement to ensure that their rights are protected and that they fully understand the terms.

Crafting a Prenuptial Agreement: The Process

Creating a prenuptial agreement that reflects the desires of both parties and complies with Illinois law involves several steps:

- Open Communication: Couples should start with open and honest discussions about their finances, assets, and what they hope to achieve with a prenuptial agreement.

- Legal Consultation: Each party should consult with their attorney who can provide advice, ensure the agreement meets all legal requirements, and represent their client’s interests.

- Drafting the Agreement: The attorneys will draft the agreement based on the couple’s decisions regarding their assets, spousal support, and any other relevant issues.

- Review and Sign: After thorough review and negotiation, if necessary, both parties sign the agreement, making it a legally binding document upon marriage.

Why Consider a Prenuptial Agreement?

Prenuptial agreements may not be romantic, but they are practical, especially in today’s world where marriages can bring together complex financial lives. They provide a clear agreement that can protect both parties and prevent future disputes. Whether it’s to protect individual assets, delineate financial responsibilities, or simply have a plan in place, a prenuptial agreement can offer peace of mind to married couples.

Call to Action: Secure Your Future with Pinkston Law Group, P.C.

At Pinkston Law Group, P.C., we understand the importance of planning for your future and protecting your assets. Our experienced family law attorneys are here to guide you through the process of creating a prenuptial agreement that aligns with your values and legal requirements in Illinois. Whether you’re blending families, entering into marriage with significant assets, or looking for financial clarity and security, we’re here to help.

Don’t leave your future to chance. Contact Pinkston Law Group, P.C. today to schedule a consultation and learn how a prenuptial agreement can be a valuable part of your marriage planning. Together, we can create a legal framework that supports your marriage with clarity, fairness, and peace of mind.