Understanding Alimony in Illinois: A Comprehensive Guide

Divorce can be an emotionally and financially challenging process. Among the many issues that arise during divorce proceedings, one of the most significant is the question of alimony, also known as spousal support or maintenance. Alimony refers to payments made by one spouse to the other following a divorce or legal separation. Its purpose is to address the financial disparity between spouses and ensure that neither is unfairly disadvantaged after the marriage ends. In Illinois, the laws governing alimony have evolved to create a more equitable system, aiming to meet the needs of both parties.

This blog provides an overview of how alimony works in Illinois, focusing on its purpose, the factors courts consider in awarding alimony, and the various types of alimony available.

What Is Alimony and Why Is It Awarded?

Alimony is a court-ordered payment from one spouse to another after a divorce or legal separation. The key objective of alimony is to provide financial support to the spouse who was financially dependent on the other during the marriage. This ensures that the financially weaker spouse can maintain a standard of living reasonably similar to the one enjoyed during the marriage.

While the concept of alimony may seem straightforward, its application in Illinois is far from automatic. Unlike child support, which is calculated using a specific formula, alimony is more flexible. Illinois courts look at a variety of factors to determine if one spouse should receive support, and if so, how much and for how long.

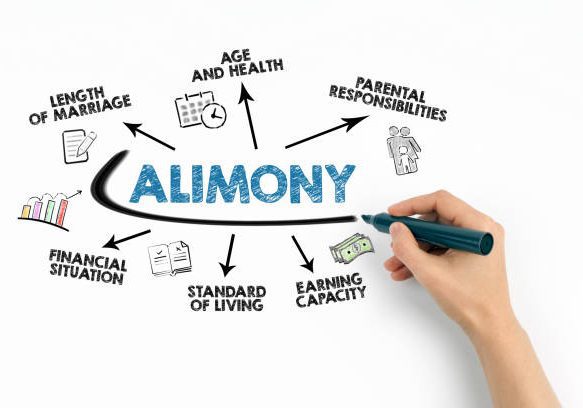

Factors Considered in Alimony Awards

Illinois courts take a nuanced approach when deciding whether to award alimony. Each case is unique, and the court carefully examines both parties’ financial situations. Some of the most critical factors considered include:

- The income and property of each spouse: This includes both marital and non-marital property, as well as any income from employment, investments, or other sources.

- The needs of each party: The court considers each spouse’s reasonable needs and whether they can meet those needs independently.

- The earning capacity of each spouse: If one spouse is unable to support themselves due to a lack of skills or employment opportunities, this factor becomes essential.

- Any impairment to future earning capacity: The court evaluates whether one spouse sacrificed education or career opportunities to benefit the marriage or raise children, leaving them at a disadvantage post-divorce.

- The duration of the marriage: Generally, the longer the marriage, the more likely alimony will be awarded, as longer marriages often involve greater financial entanglement.

- The standard of living during the marriage: Courts strive to ensure that the recipient spouse can maintain a lifestyle that is not dramatically reduced post-divorce.

- Contributions to the other spouse’s education or career: If one spouse contributed significantly to the other’s earning capacity, the court may take this into account.

These and other factors help the court arrive at a fair and just decision on alimony, with the aim of creating financial stability for both parties after divorce.

Types of Alimony in Illinois

There are several types of alimony that the court may order depending on the circumstances of the marriage and divorce. These include:

- Temporary Alimony: This type of alimony is awarded while the divorce is still pending. It ensures that a spouse has the financial resources to cover immediate expenses during the divorce process. Temporary alimony typically ends once the divorce is finalized and the court makes a final ruling on long-term alimony.

- Rehabilitative Alimony: One of the most common types of alimony, rehabilitative alimony is awarded to a spouse who needs time to become self-sufficient. It is often given when one spouse requires additional education or job training to re-enter the workforce. The court sets a specific period for this type of alimony, after which it ends unless further action is taken.

- Fixed-Term Alimony: Fixed-term alimony is awarded for a set period and is generally used in situations where one spouse needs time to adjust to post-divorce life. This might apply when a spouse who stayed home to raise children needs time to find employment but is expected to become self-supporting eventually.

- Permanent Alimony: Though less common today, permanent alimony may be awarded in cases of long-term marriages where one spouse is unlikely to become financially independent. This type of alimony usually continues until the recipient remarries, cohabitates with a new partner, or passes away.

Modifying or Terminating Alimony

Alimony in Illinois can be modified or terminated under certain circumstances. If there is a significant change in the financial situation of either party, such as a loss of income, a promotion, or a major health issue, the court may adjust the alimony payments. Additionally, alimony typically ends if the recipient remarries or enters into a cohabitating relationship. Retirement may also be a basis for modification or termination of alimony, depending on the financial circumstances of the paying spouse.

Conclusion

Alimony is a critical tool that helps ensure financial fairness in Illinois divorce proceedings. Its purpose is to provide financial assistance to a spouse who needs support in transitioning to life after marriage. Courts carefully evaluate a variety of factors to determine whether alimony is appropriate and, if so, how much and for how long. Understanding how Illinois law addresses alimony can help divorcing spouses plan for their financial futures and ensure that their rights are protected.