Tax Implications of Child Support in Illinois: What You Need to Know

Child support can significantly impact the financial landscape for both the parent who receives it and the one who pays it. In Illinois, as in many other states, the intricacies of tax laws around child support include several important factors that parents should consider to manage their finances effectively. This blog post explores how child support payments affect taxation for both receiving and paying parents.

For the Receiving Parent

Tax Exemption and Reporting

- Non-Taxable Income: Child support payments received by a parent are not considered taxable income by the Internal Revenue Service (IRS). This means that when you receive child support, you do not need to declare it as income on your federal or state tax returns.

- Use of Funds: Although child support is non-taxable, how the receiving parent uses the funds can have tax implications. For example, using child support money to pay for medical expenses could have implications if you’re deducting those expenses on your taxes.

- Child-Related Deductions and Credits: The receiving parent typically claims the child as a dependent, allowing access to various tax credits such as the Child Tax Credit, Earned Income Tax Credit, and dependent care credits, assuming they meet other IRS criteria. These credits can significantly reduce your tax liability.

For the Paying Parent

Tax Obligations and Deductions

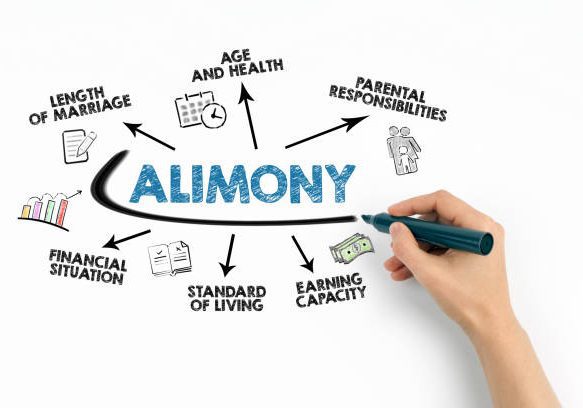

- Non-Deductible Payments: In contrast to alimony, child support payments are not tax-deductible for the parent who makes them. This means the paying parent cannot reduce their taxable income by the amount of child support paid. This rule is crucial to understand as it directly impacts the calculation of your net income and tax liabilities.

- Legal Fees: Any legal expenses incurred to obtain or enforce a child support order are not deductible. This includes attorney fees and related costs, which contrasts with certain types of divorce-related legal fees that may be deductible under specific circumstances.

- Impact on Filing Status: The paying parent’s ability to file as head of household or claim tax credits related to the child (like the Child Tax Credit) typically depends on a custody arrangement or specific terms set by the court. If the non-custodial parent does not meet the criteria for claiming the child as a dependent, they lose access to these tax benefits.

Joint Considerations

Dependency Exemptions and Claiming Dependents

- Agreements on Dependency Exemptions: If parents have multiple children, they might agree (often through legal stipulations) that one parent claims some children while the other claims the rest. Such agreements should be clearly drafted to avoid conflicts and misunderstandings regarding tax filings.

- IRS Tie-Breaking Rules: In cases where both parents attempt to claim the same dependents, the IRS has specific tie-breaking rules. These rules generally favor the parent with whom the child spent more nights during the year as the custodial parent, eligible to claim the associated tax benefits.

Amended Returns and Future Changes

- Adjusting to Changes: Life changes such as remarriage, relocation, or changes in custody can affect child support payments and tax implications. It’s vital for both parents to review their tax situations annually and adjust their filings and withholdings as necessary.

- Amended Returns: If you discover that child support or dependency claims were filed incorrectly in previous years, it may be necessary to file an amended return. This process can correct past mistakes and potentially recover overpaid taxes.

Conclusion

Understanding the tax implications of child support in Illinois is crucial for both the paying and receiving parent. It ensures compliance with tax laws and helps parents make informed financial decisions. Parents should consider consulting with a tax professional to navigate these issues effectively and to take full advantage of available tax benefits related to child support arrangements.