How Alimony Works in Illinois

In the midst of a divorce, understanding the financial implications is crucial for both parties involved. One of the key components that often arise during divorce proceedings is alimony, also known as spousal support. At Pinkston Law Group, P.C., we are committed to guiding our clients through the complexities of alimony in Illinois, ensuring they are well-informed and prepared for the process. This article aims to demystify what alimony is, who qualifies for it, how it’s calculated, and how you can navigate these waters with the assistance of a knowledgeable attorney.

What is Alimony?

Alimony refers to the financial support that one spouse pays to the other after a divorce. The purpose of alimony is to mitigate any unfair economic effects of a divorce by providing a continuing income to a non-wage-earning or lower-wage-earning spouse. In Illinois, alimony is officially referred to as “spousal maintenance.”

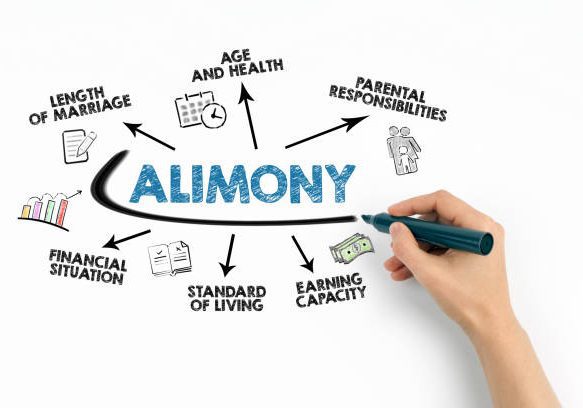

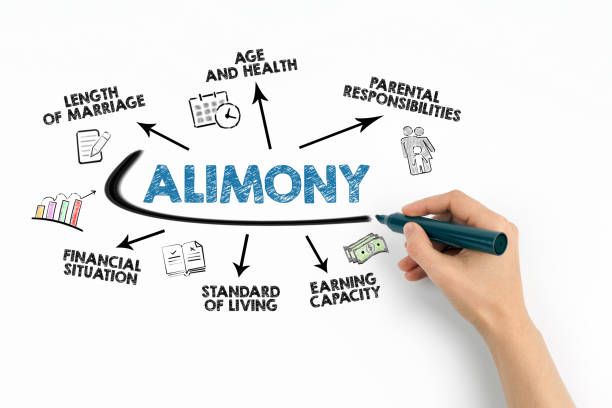

Who Qualifies for Alimony in Illinois?

The qualification for alimony in Illinois is not automatic. Instead, the court considers several factors to determine whether spousal maintenance is appropriate. These factors include, but are not limited to, the income and property of each spouse, the needs of each spouse, the present and future earning capacity of each spouse, and any impairment to the earning capacity of the spouse seeking maintenance due to domestic duties or foregoing or delaying education, training, employment, or career opportunities due to the marriage.

How is Alimony Calculated in Illinois?

Illinois law provides guidelines for calculating spousal maintenance, aiming to create consistency and predictability in divorce proceedings. The calculation typically involves a specific formula for marriages under 20 years, where the amount of alimony is determined by taking 33.3% of the payer’s net income minus 25% of the receiver’s net income. The sum received by the payee, when added to their net income, should not exceed 40% of the combined net income of both parties.

For marriages of 20 years or more, the court may order maintenance for either a fixed period that could equal the length of the marriage or for an indefinite period.

It’s important to note that these guidelines apply when the combined gross annual income of both parties is below a certain threshold, which is subject to periodic updates. For higher-income cases, the court has discretion in determining the amount and duration of maintenance.

Navigating Alimony with Pinkston Law Group, P.C.

The determination and calculation of alimony involve careful consideration of numerous factors and a thorough understanding of Illinois law. Whether you are potentially receiving or paying alimony, having an experienced attorney by your side can make a significant difference in the outcome of your case.

At Pinkston Law Group, P.C., we specialize in family law and have extensive experience dealing with alimony cases in Illinois. Our approach is to provide personalized legal strategies tailored to the unique circumstances of each client, ensuring their rights are protected, and their financial interests are secured.

Call to Action

If you are going through a divorce and have questions about alimony, or if you need legal representation to navigate the complexities of spousal maintenance, we invite you to contact Pinkston Law Group, P.C. Our dedicated team is ready to provide the legal support you need to move forward with confidence. Schedule a consultation today to discuss your case and explore your options with a skilled attorney who understands Illinois alimony laws. Let us help you secure a fair and just outcome in your divorce proceedings.