Determining Alimony in Illinois: Key Factors Courts Consider

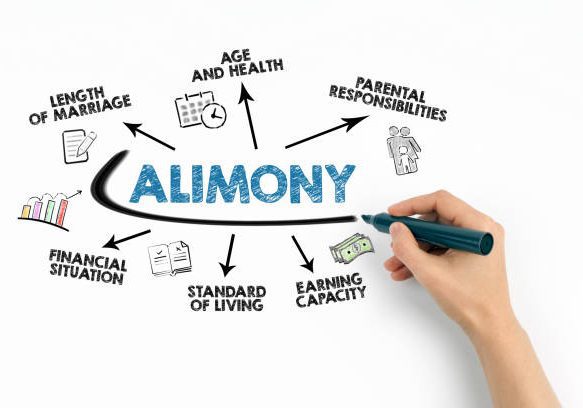

When couples in Illinois decide to divorce, one of the critical issues they may face is the determination of alimony, also known as “spousal maintenance.” Alimony is designed to provide financial support to the lower-earning spouse, helping them maintain a standard of living comparable to what they experienced during the marriage. However, unlike child support, alimony is not automatically granted in every divorce. Instead, it’s determined based on a variety of factors specific to each couple’s circumstances.

Here, we’ll break down the key factors that courts in Illinois consider when determining alimony.

1. Length of the Marriage

One of the most significant factors in determining alimony is the length of the marriage. Typically, the longer the marriage, the more likely it is that alimony will be awarded, and for a longer duration. This is because longer marriages often involve a greater intertwining of finances and life circumstances, making it harder for the lower-earning spouse to adjust to financial independence.

For short-term marriages, alimony may be minimal or even non-existent unless there are special circumstances, such as one spouse’s temporary disability or educational contributions to the other spouse’s career.

Impact: Longer marriages often result in higher and longer-lasting alimony payments.

2. Income and Property of Both Parties

The financial resources of both spouses are critical in alimony determinations. The court examines the income, property, and financial resources each party has at their disposal. This includes looking at earned income, investments, retirement accounts, and other assets.

If one spouse earns significantly more than the other, alimony is more likely to be awarded. Additionally, if one spouse holds the majority of the marital assets, the other spouse may receive maintenance to help equalize their financial standing.

Impact: Significant income or property disparities between the parties increase the likelihood of alimony.

3. Needs of the Parties

Another consideration is the financial needs of both spouses. The court evaluates each party’s living expenses, debts, and overall financial situation. Alimony may be awarded to ensure the lower-earning spouse can cover their basic living expenses, such as housing, food, transportation, and healthcare.

If the paying spouse also has high financial needs, the court may reduce the amount of alimony to ensure both parties can meet their financial obligations.

Impact: Alimony is designed to meet the financial needs of the receiving spouse while balancing the payer’s ability to contribute.

4. Earning Capacity

In determining alimony, the court will also look at the earning capacity of both spouses. This includes current income as well as the potential to earn in the future. For instance, if one spouse left the workforce or worked part-time to care for children, they might need time and training to regain full earning potential.

In these cases, rehabilitative alimony may be awarded to help the spouse become financially independent through education or job training. Conversely, if the lower-earning spouse has a higher earning potential, the court may award less alimony, expecting them to become self-sufficient sooner.

Impact: Alimony may be adjusted based on each spouse’s ability to earn income in the future.

5. Contributions to the Marriage

The court also considers the contributions each spouse made during the marriage. This includes not only financial contributions but also non-economic contributions, such as raising children or managing the household. If one spouse sacrificed their career or education to support the family, they may be awarded alimony to help compensate for this loss of earning potential.

For example, a spouse who supported the other through medical school or managed the home so the other could advance their career may receive alimony as a form of financial recognition.

Impact: Alimony can reflect a spouse’s contributions to the marriage, especially if it involved career sacrifices.

6. Age and Health of the Parties

The age and health of both parties are also taken into account. If the receiving spouse is older or has health issues that limit their ability to work, the court may award permanent or long-term alimony. Similarly, if the paying spouse is nearing retirement or has significant health problems, this might affect their ability to make alimony payments.

Impact: Age or health issues may influence the duration and amount of alimony, especially when one spouse is unable to work.

7. Standard of Living During the Marriage

Alimony is often intended to help the lower-earning spouse maintain a standard of living similar to what they experienced during the marriage. The court examines the lifestyle the couple had, including factors like housing, travel, and spending habits, and tries to ensure that the spouse receiving alimony is not forced into a significantly lower standard of living after the divorce.

Impact: Courts aim to prevent significant lifestyle changes for the receiving spouse post-divorce.

8. Any Agreements Between the Parties

If the couple has a prenuptial or postnuptial agreement that outlines alimony arrangements, the court will generally honor the terms of the agreement as long as it is fair and does not violate Illinois law. These agreements can significantly influence the determination of alimony, either by waiving it entirely or specifying certain amounts and conditions.

Impact: Prenuptial or postnuptial agreements may control or influence alimony decisions.

Conclusion

Alimony in Illinois is determined through a careful analysis of multiple factors, ensuring that the arrangement is fair for both parties. Courts aim to balance the financial needs of the receiving spouse with the ability of the paying spouse to contribute, while also considering the contributions made during the marriage and each spouse’s potential for future financial success. Understanding these factors can help you prepare for discussions about alimony and ensure that the outcome is equitable.

If you’re going through a divorce in Illinois, consulting with a knowledgeable attorney can help ensure that your alimony arrangement reflects your specific circumstances and protects your financial future.